Corporate Venture

Corporate venturing—also referred to as corporate venture capital (CVC)—involves large corporations directly investing funds into innovative startup companies. These investments are often structured through joint venture (JV) agreements or equity acquisitions, allowing corporations to support startups while gaining access to cutting-edge technologies and ideas. Beyond funding, corporations often offer strategic guidance, marketing expertise, and operational support to help these startups thrive.

Robinson Ventures has decades of experience establishing and managing corporate venture functions and funds. These initiatives are carefully aligned with each corporation’s innovation strategy and long-term goals. Whether you're looking to support a groundbreaking startup, a growing small business, or a mature enterprise, there’s never a wrong time to explore the potential of corporate venturing.

If you’re interested in discussing what it takes to establish or enhance a corporate venture fund, click the “Contact Us” button at the bottom of this page. Let’s shape the future of innovation, together!

Key Modalities of Corporate Venture Investing

Corporate venture investing encompasses several distinct approaches, each tailored to different stages of a startup's lifecycle and strategic objectives. Robinson Ventures helps corporations navigate these modalities to align their investments with innovation goals.

Here’s a closer look:

1. Early-Stage Financing

Supporting startups in their earliest phase—before commercial production or sales—often involves small funding amounts or “sweat equity.”

2. Seed Capital Funding

Initial capital provided to cover early operating expenses and attract venture capitalists. These investments are typically modest, similar to "sweat equity", but essential for getting a startup off the ground.

3. Expansion Financing

Capital for portfolio companies aiming to grow—whether through new product launches, facility expansions, marketing improvements, or other scaling activities. These amounts are significantly larger and may involve collaboration with other investors.

4. Mergers and Acquisitions

Financing startup acquisitions or aligning complementary business lines and products. These investments tend to be substantial and help unify brands or strategic goals.

5. Initial Public Offering (IPO)

Through a public stock market offering, the Corporate Venture Fund exits its investment while recapitalizing the parent company or venture fund.

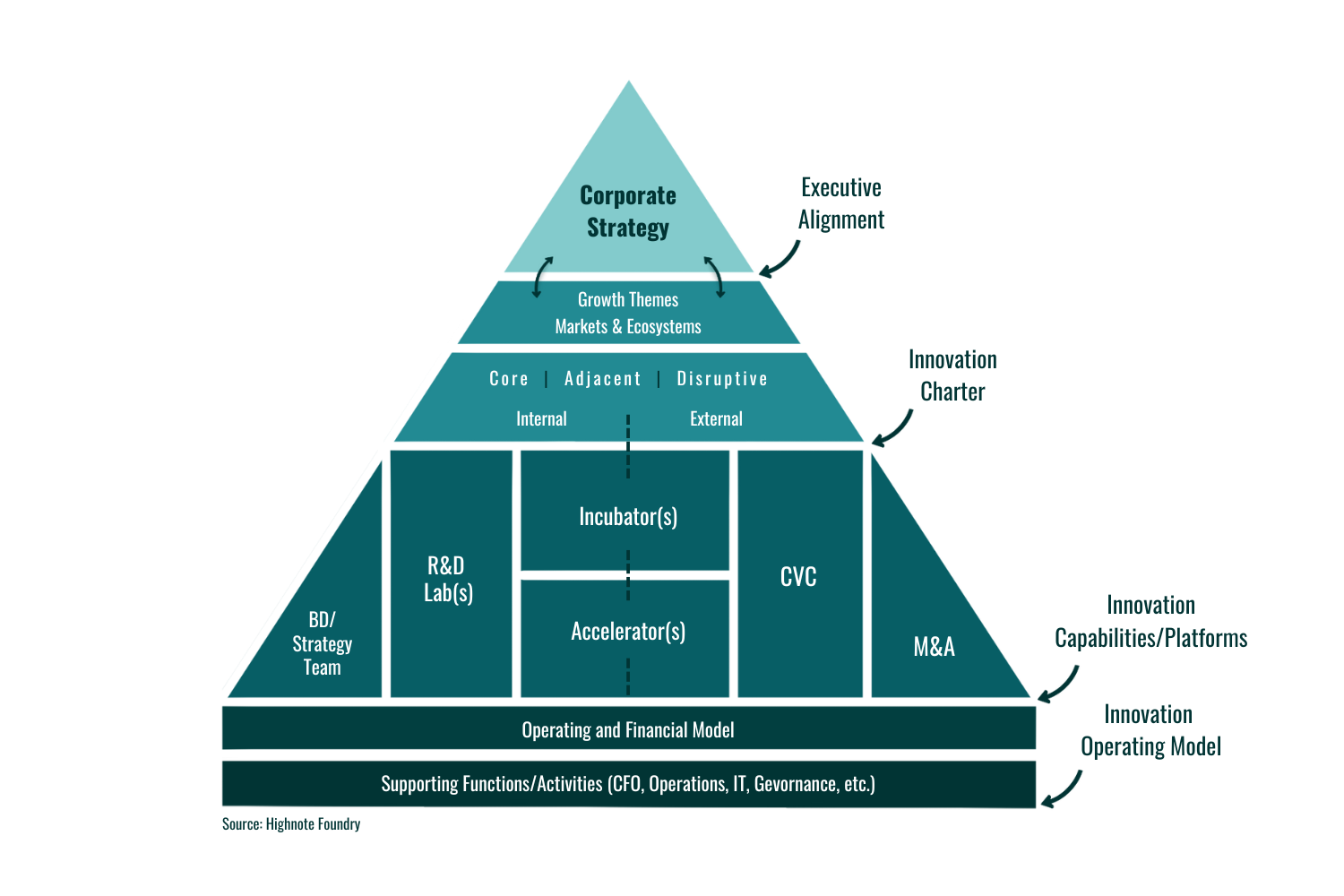

Structuring CVC for Long-Term Success

As you can see via the graphic below, a successful corporate venture function requires alignment across multiple levels within the organization—spanning corporate culture, board priorities, executive leadership, and operational teams responsible for innovation and venture activities. With Robinson Ventures’ guidance, your organization can seamlessly integrate a CVC function into its strategic framework to unlock innovation and growth.

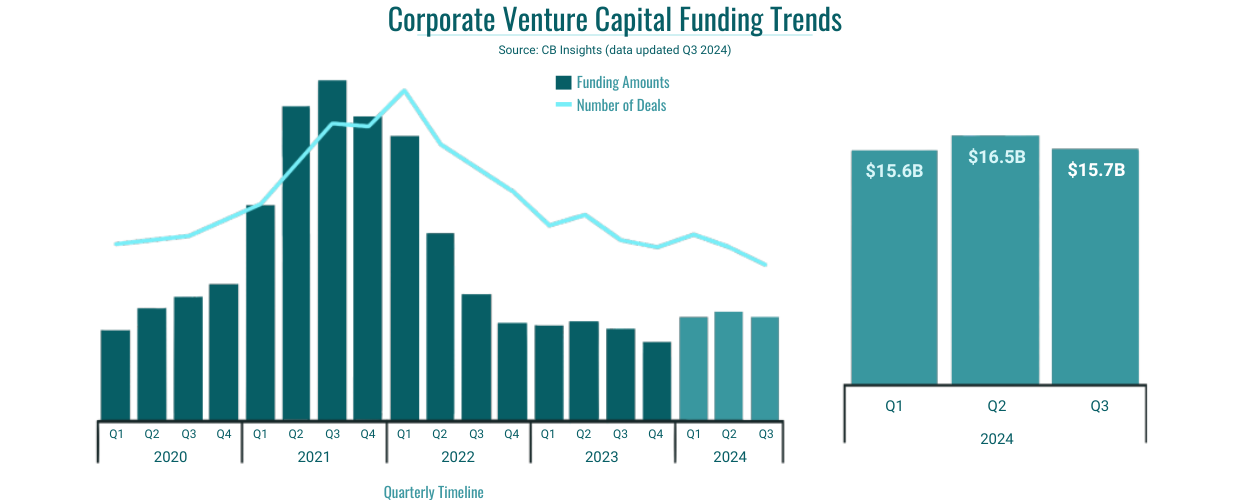

trends in corporate venture capital

The data here highlights recent trends in CVC funding, showing key shifts in both total funding and the number of deals. In Q3 of 2024, for example, disclosed equity funding decreased by 5% quarter-over-quarter, reflecting shifts in the global economic and innovation landscape. These insights help organizations adapt and refine their venture strategies to stay ahead in a competitive market.

Robinson Ventures specializes in guiding corporations through these fluctuations, offering tailored strategies to align CVC investments with market conditions and innovation goals. We help organizations identify high-potential opportunities, mitigate risks, and position their venture functions for long-term success—even amidst changing funding landscapes.

Must-Read Articles:

-

This article from Harvard Business Review explores how corporate venturing can help companies respond to market changes, gain insights, and stimulate demand for their products: hbr.org

-

The IESE discusses how corporations can collaborate with startups and other companies to unlock innovation and reduce risks: www.iese.edu

-

This piece outlines the advantages of CVC, such as access to distribution networks, strategic partnerships, and financial returns: www.forbes.com

-

The State of CVC Report 2021 by Silicon Valley Bank highlights trends like early-stage investment focus, faster deal approvals, and the growing influence of CVCs in board decisions and global expansion: www.svb.com