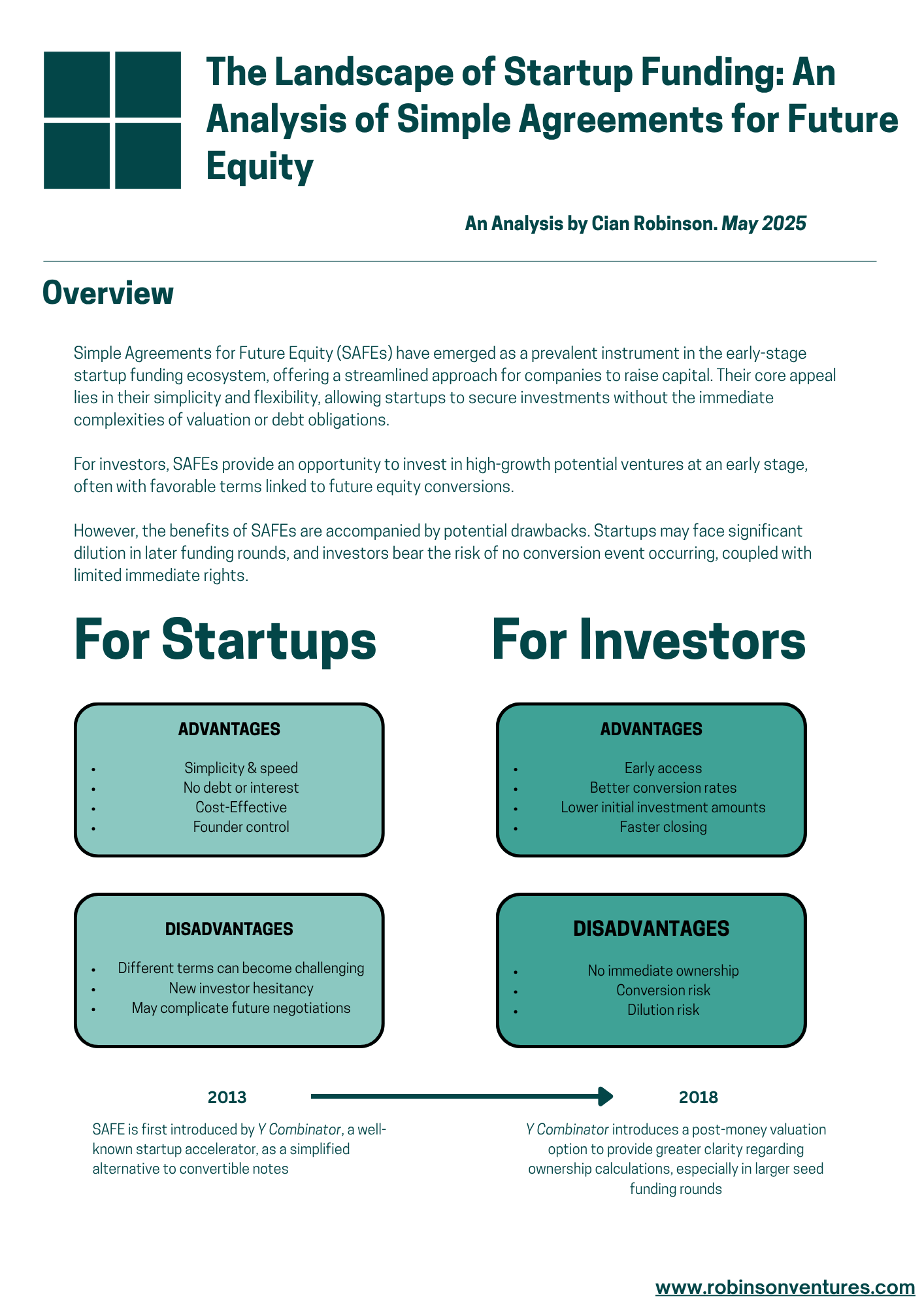

Simple Agreements for Future Equity (SAFEs) have emerged as a prevalent instrument in the early-stage startup funding ecosystem, offering a streamlined approach for companies to raise capital. Their core appeal lies in their simplicity and flexibility, allowing startups to secure investments without the immediate complexities of valuation or debt obligations. For investors, SAFEs provide an opportunity to invest in high-growth potential ventures at an early stage, often with favorable terms linked to future equity conversions. However, the benefits of SAFEs are accompanied by potential drawbacks. Startups may face significant dilution in later funding rounds, and investors bear the risk of no conversion event occurring, coupled with limited immediate rights.

This white paper provides a comprehensive analysis of the pros and cons of SAFEs for both startups and investors, compares them with alternative funding methods, explores the legal and tax implications, and outlines the various forms and common terms associated with these agreements.

Read the full document here.